Automotive Aftermarket M&A

Driving Success: Capstone’s Expertise in Mobility Investment Banking

In order to deliver successful outcomes for clients, all financial professionals must have deep knowledge of the industries in which their clients operate as well as intimate relationships with strategic and financial entities that invest and/or operate in the space. Capstone is no different – we have solely focused on mobility investment banking since 1990. As automotive aftermarket and auto-tech investment bankers, we have worked with every operator in the industry, from the legacy “Detroit-based” companies that have grown to dominate the industry to startups developing innovative automotive-grade solutions that are achieving never before seen advances in technology for the mobility industry.

Capstone leverages its relationships and expertise within the industry as an expert team within automotive aftermarket investment banking and auto-tech investment banking. We understand the space in which you operate, and we deliver successful outcomes across your sell-side, buy-side, and growth capital goals. Check out our FAQ below for more information.

Experience in Autotech

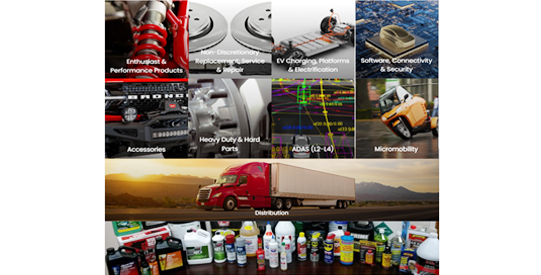

In 2015 we made the move to Silicon Valley to also cover autotech, a technology driven sub-industry of the mobility industry. We support autotech firms that are advancing electrification (vehicle platforms and charging infrastructure), developing software, security, and connectivity solutions, data analytics, safety/ADAS (L2-L5), micromobility, mobility services, and various component and system suppliers in the automotive aftermarket space.

In 2015 we made the move to Silicon Valley to also cover autotech, a technology driven sub-industry of the mobility industry. We support autotech firms that are advancing electrification (vehicle platforms and charging infrastructure), developing software, security, and connectivity solutions, data analytics, safety/ADAS (L2-L5), micromobility, mobility services, and various component and system suppliers in the automotive aftermarket space.

Our clients are designing and developing technology across: novel public and commercial EV charging stations, advanced sensors and collision avoidance systems like LiDAR, Ai/ML, control systems, telematics, predictive maintenance, fleet management, vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I) and vehicle-to-everything (V2X), infotainment systems, touch technology, ride-hailing, and various subscription-based services that can be controlled via an app on your phone, and much more. The Capstone team is extremely excited and motivated to help drive the future of mobility by providing capital solutions and scalability for our autotech clients.

Our Automotive Aftermarket and Autotech Clients

Our general rule of thumb is to support automotive aftermarket investment banking clients that generate over $1.5M in EBITDA. As far as autotech clients, we support late-stage startups all the way through those ready for a full M&A event. We do not do venture capital (VC), so it’s important that our autotech clients have generally completed their Series-B and have traction in the form of revenue, IP (defensibility), purchase orders, etc.

Our general rule of thumb is to support automotive aftermarket investment banking clients that generate over $1.5M in EBITDA. As far as autotech clients, we support late-stage startups all the way through those ready for a full M&A event. We do not do venture capital (VC), so it’s important that our autotech clients have generally completed their Series-B and have traction in the form of revenue, IP (defensibility), purchase orders, etc.

As autotech investment bankers, we respectfully understand how difficult it is to land your first Tier 1, OEM, or big commercial deal as well as the timetables required! The reason we target the autotech clients that we do is that the aforementioned significantly increases your chances of receiving significant institutional funding, or, if you are looking for an exit, a solid foundation for full M&A discussions. Traction in the form of revenue, POs, IP, etc. is critical for Tier 1s, OEMs, strategics, and financial institutions to be convinced you are no longer in need of venture capital.

Experts in Mergers & Acquisitions

Automotive aftermarket investment banking professionals facilitate mergers and acquisitions by conducting due diligence, identifying potential targets or buyers, negotiating deal terms, structuring transactions, and providing valuation analysis. It is a full time-job, usually equating to a minimum of 300+ man hours of auto aftermarket investment banking work on Capstone’s side.

Automotive aftermarket investment banking professionals facilitate mergers and acquisitions by conducting due diligence, identifying potential targets or buyers, negotiating deal terms, structuring transactions, and providing valuation analysis. It is a full time-job, usually equating to a minimum of 300+ man hours of auto aftermarket investment banking work on Capstone’s side.

We support automotive aftermarket parts, accessories, and specialty equipment manufacturers, remanufacturers, wholesalers/distributors, online marketplaces/dealers, and service providers. Our clients produce discretionary and non-discretionary products ranging from enthusiast and performance products, electronics, heavy duty and hard parts, tire and wheels, tools and equipment, chemicals, tuning, restoration and customization, and software services.

Stay in Tune With Industry Trends

This is one of our differentiators as a boutique group specializing in auto aftermarket investment banking. We stay aware of the most current trends in several ways, particularly in the realm of automotive aftermarket M&A (mergers and acquisitions). When we bring companies to market, high-volume interaction with both financial and strategic entities occurs. During those conversations, we gain invaluable knowledge about their strategies as well as their viewpoints on certain companies or technologies.

This is one of our differentiators as a boutique group specializing in auto aftermarket investment banking. We stay aware of the most current trends in several ways, particularly in the realm of automotive aftermarket M&A (mergers and acquisitions). When we bring companies to market, high-volume interaction with both financial and strategic entities occurs. During those conversations, we gain invaluable knowledge about their strategies as well as their viewpoints on certain companies or technologies.

What’s interesting is that we often find that the buyers/targets we are speaking with share drastically different opinions. After having numerous conversations about a certain topic or topics, Capstone becomes much better informed on the particular subject matter. Additionally, we survey our network annually and have phone conversations (meetings) with founders, PE firms, etc., regularly to discuss strategies and share notes.

Another invaluable medium we use to stay up to date on industry trends is attending in-person conferences. We are a member of AASA/MEMA and the Autotech Council, which hosts regular conferences. In addition, we always attend AAPEX/SEMA to network with industry stakeholders and attend learning sessions to expand our automotive investment banking expertise.

Contact Our Automotive & Aftermarket Investment Banking Team

Our relationships with our clients start, on average, two to three years in advance – in some cases, up to ten years in advance. Over the course of this timeline, we start to learn about your business and your goals. Every founder generally has different goals, but what we often see is that many have very different strategies as well to achieve those goals. As stated above, we are the only investment bank serving just the automotive aftermarket and autotech space. As an M&A advisor, we will provide our automotive aftermarket investment banking advice to help you best position yourself and your company to achieve its goals.

FAQ

What mobility investment banking services do you offer?

We specialize in growth capital, buy-side advisory, and sell-side advisory in automotive investment banking. This includes minority investments, majority investments, and 100% purchase/sale transactions.

My life goal is to IPO or take this specific business public. Why should I consider a private placement?

The best way to compare an IPO to a private placement is by analyzing access capital and liquidity as well as understanding the freedom to operate vs. having to answer to shareholders. Of course, the credibility and visibility from an IPO exit as opposed to a more private exit via a private placement should be considered.

It’s not always common knowledge that private placements often provide founders with significant access to capital and more liquidity through appropriate deal structuring than most people think. Additionally, the regulatory burden, excessive costs, and rigorous reporting and compliance are critical to consider. SEC compliance required across financial and accounting, legal, and other internal administrations as well as having to answer to shareholders and the media significantly impact the company’s operating freedom. As in most situations, the best path forward is generally on a case by case basis. We are happy to walk through in more detail the pros and cons of each exit path.

What role do automotive aftermarket and auto-tech investment bankers play in capital raising?

We specialize in growth capital, buy-side advisory, and sell-side advisory in automotive investment banking. This includes minority investments, majority investments, and 100% purchase/sale transactions.

Do you support clients in other countries besides the US?

Yes! We currently have a client in Israel and one in the UK. We have a lot of experience structuring transactions across different regulatory bodies, taxing jurisdictions, languages, etc.